Quotidian Investments Monthly Commentary – January 2022

As you may recall from our December 2021 monthly briefing report we entered 2022 with a degree of optimism for the New Year which flowed from the fact that the potential headwinds to stock-market activity and investment performance were clearly defined and seemingly under both political and financial control. In the event, and as you are probably aware, January turned out to be profoundly negative throughout the month as global equity markets (and especially the tech-heavy US Nasdaq index) were relentlessly marked down day after day to the point of wildness. Intra-day price swings of close to10% or more were commonplace and beyond any relationship to reason, logic or economic reality.

As I stated in last month’s report (and is worth emphasizing again in respect of January): market makers sought to construct flimsy excuses to cover relentlessly negative and ruthless interpretations of what, in fact, were anodyne economic issues. Sadly, deviousness and self-interest posing as rational commentary and faithful analysis seems to be more frequent in market-making circles nowadays and, as a consequence, credibility in genuine market pricing is straying towards an all-time low. Let me expand on that theme.

Again, to quote from December’s briefing note. We anticipate that inflation (particularly in the USA, in Europe and in the United Kingdom) will continue at its recent higher levels (or even move marginally higher again over the next five months or so) but we expect it to fall back again thereafter and the US Federal Reserve (at its meeting on14th/15th December) has stated and stood by its prediction that the US inflation rate at the end of 2022 will be back to their 2% target rate. With this in mind, the Fed intended to increase interest rates in baby steps three times in 2022 (indicating that the first of those moves would be in March) and then another three times in 2023.

I have a great deal of respect for Jerome Powell (chairman of the Federal Reserve); he speaks with intelligence and clarity (unlike a number of his predecessors in that role) and does not seek to mislead or confuse. He has a record of doing what he says he’s going to do and, in my opinion, he sets out the Fed’s strategic plans clearly and honestly so that even you and I can understand them.

It seemed as if Federal Reserve couldn’t have made its strategic points any clearer in its statement after its14th/15th December meeting (and well ahead of the traditional media blackout that precedes its next policy meeting, its first of the 2022 year, on Jan 25th/26th).

Enter stage left our old friend Jamie Dimon, chairman and chief executive of the US investment bank J P Morgan. Dimon has an interesting history of his mouth having good ‘ideas’ before apparently consulting his brain. Indeed, as recently as mid-November he made a disparaging comment about the Chinese Communist Party and then felt the need to apologise (but, of course, the comment was well and truly in the public domain by then).

Whether this happens by accident or design is open to debate although there often seems to be a hint of self-interest to the timings of his pronouncements. Let’s just call it disingenuous.

Coinciding with the start of 2022 stock-market trading Dimon felt the need to share with the world his considered and confident opinion that the Federal Reserve would, in fact, increase US interest rates no less than seven times in 2022. That sort of comment (again whether by accident or design) from that sort of source is highly likely to send shudders through the equity markets and, indeed, that is what it did on the first trading day of the New Year and for the rest of the month thereafter.

For all I know, the poor man may have an aural problem which makes it challenging for him to clearly hear strategic plans despite them having been repeated on a number of occasions. Strangely, though, the man doesn’t have an oral problem and rather seems to like the sound of his own voice. On the other hand, perhaps it’s the aural problem that leads to the oral instability. Bizarrely, however, wisdom only seems to come after the event. From my observations over many years past, my opinion is that Dimon is less of a prophet and more of a man with a self-interested eye for personal (or corporate) profit. Not to be out-done, his quasi opposite number at a senior level in Goldman Sachs joined in the fun but (no doubt to avoid a charge of plagiarism) expressed his view that US interest rates would be lifted a mere four or five times this year. Leaders of other US investment banks joined in the chorus (which could, in truth, could have done with a few more rehearsals and a pre-concert tuning). It seems that some of these individuals have missed a potentially more lucrative career opportunities as stand-ins for Laurel and Hardy.

These people, naturally, are acutely aware of the market-moving power of their statements and, of course, they have a vested interest in promoting fear into the equity markets; it creates panic trading which they (in corporate or personal form) could benefit from. In the first week of equity-market trading, for example, $1.1 trillion was wiped off the value of the Nasdaq index. I wonder if all these events are somehow connected. These chaps couldn’t be feathering their own nests could they; that would be unethical and immoral. Perish that unworthy thought.

Quite simply, I trust Jerome Powell and (until proven otherwise) am content to accept his ability to achieve the Fed’s strategy for US interest rates and the control of US inflation. Frankly, I wouldn’t take advice on crossing the road safely from the rest of this hall of shame who, to my no doubt cynical eyes, simply demonstrate the ongoing existence of modern American cowboys (but perhaps not as well loved as the originals).

Now let me move on from that background setting to the actuality of stock market activity since the start of the New Year and its synthetic, confected and unreal nature. The first trading day of 2022 was Monday 3rd January and it is instructive to note that this was a Bank Holiday in the UK and so our markets were closed. The USA markets, though, were open and trading (and being relentlessly marked down).

Day after day throughout January that same profound degree of negativity prevailed causing wild intra-day swings bordering on hysteria in equity prices. It did test patience and resolve (as no doubt it was intended to do).

Mid-January, in the early part of the quarterly results season, both J P Morgan and Goldman Sachs issued their latest financial figures for the last quarter; in both cases the numbers were disappointingly short of expectations. Specifically, they both fell short on their predictions of trading revenue volume. How strange and one can’t help but wonder if both organisations have been more closely focused on addressing that weakness to generate future profitability.

In the course of this simulated period of crazy pricing,Tesla issued its latest quarterly results and they were somewhat disappointing. Their shares dropped 25% (wiping $100 billion off the market value of the company in one day)! An amazing over-reaction.

Similarly, Netflix issued its latest results which were largely above expectations with the exception of a relatively small shortfall on just one measure. In particular, their earnings per share beat expectations by 61% but their projection of future growth fell narrowly short of anticipations. However, the prevailing negative tone of the market saw its share price marked down by 30%, again in one day. This is a successful organisation with a demonstrable and consistent record of consistently generating profits. It beggar’s belief and defies logic to take markdowns of this magnitude seriously or as realistic and justified. We bought more Netflix at this knockdown price.

On 31st January 2022 the FTSE100 index closed the month at 7464.40 (a rise of +1.08% in the month of January itself) and therefore, of course, it also stands at up +1.08% for the 2022 calendar year to date. By comparison the Quotidian Fund’s valuation at the 31st January shows a markdown of -11.15% for the first month of the year and it follows therefore that the Fund year to date figure also closed the month at -11.15%.

Of course, I realise that these figures do not look pretty nor do they make pleasant reading but they reflect a period of typical market gyrations and we know that markets always bounce back; it is simply a matter of time before they shed the hysteria and return to upward momentum and their recent highs. Please see the attached appendices for vivid proof of that assertion.

At close of play on Friday 28th January US shares, supported by the exceptional results from Microsoft and Apple (and another 5 other of our holdings all of whom reported glowing results ahead of expectations too), The closing summary from Bloomberg stated that “stocks roar back with their best day since June 2020”.

Our remaining 10 corporate holdings will be reporting their results over the next two weeks and we expect similarly positive figures from them as well. It offers further proof that, ultimately, economic performance in the real world overcomes manipulated figures and manufactured negativity based on self-interest.

That’s why we don’t panic, we don’t consolidate artificial and temporary paper markdowns into real financial losses and we only trade to buy more of our carefully selected holdings at unrealistically low prices. In that respect the ‘January sales’ season has been very kind to us.

It is also very worthwhile to note that the Federal Reserve in its January strategy meeting held its federal funds rate unchanged and indicated, yet again, the probability of next raising the rate in March. So much for those wild, disingenuous and over-emotional predictions of multiple rate increases throughout 2022.

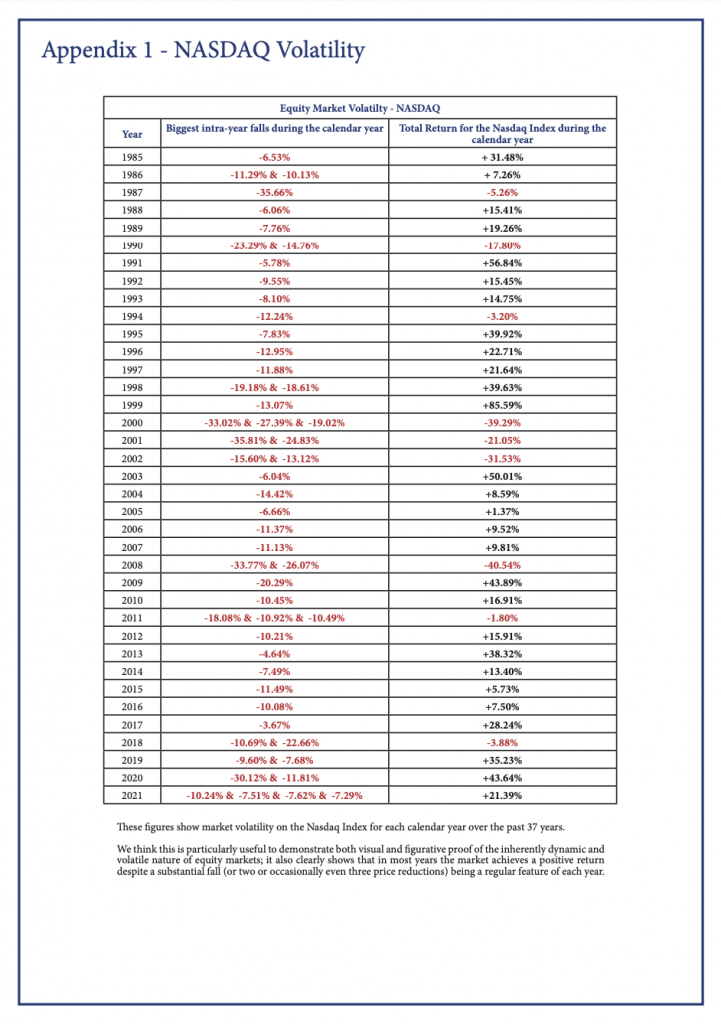

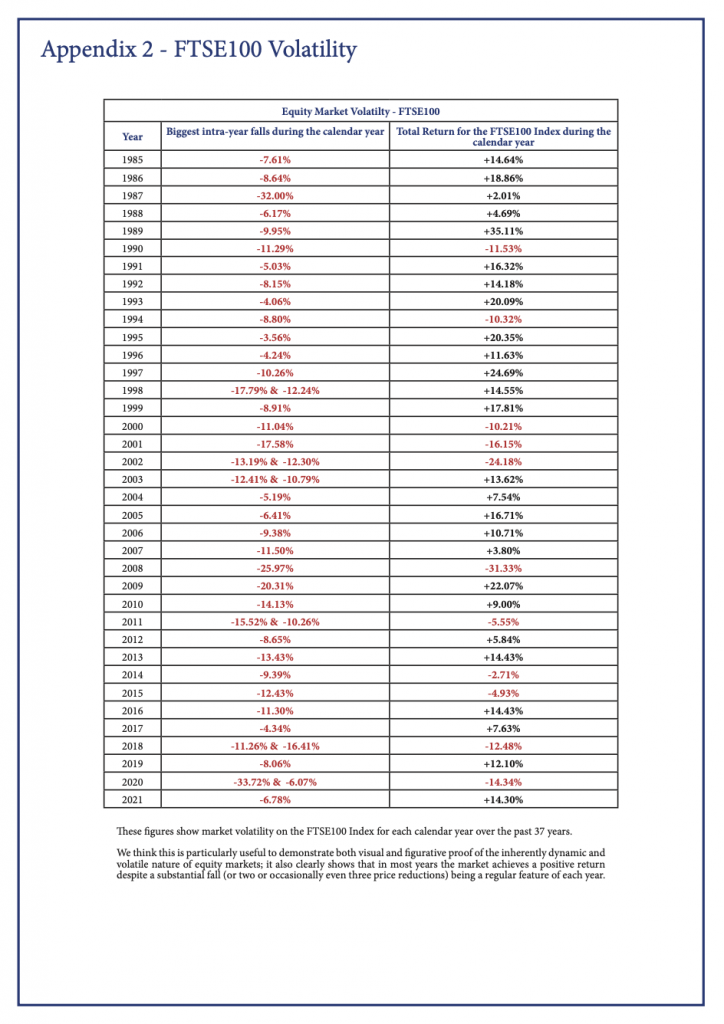

Appendices

Equity market volatility: Every year without exception stock-markets go through periods of ‘correction’ when equity prices are marked down at least once (and sometimes two, three or four times) in the calendar year. Often this is related to economic reality but occasionally it is synthetic.

Markets always regain their poise and return eventually to their recent highs before going higher again; it is only a function of time, patience, belief and the courage to wait.

I attach two spreadsheets, one for the Nasdaq index and the other for the FTSE100 (the two areas we are currently invested in) but the same rationale and behaviour applies to all equity markets.

In column 1 you can see that every year has at least one market correction (and sometimes multiple markdowns).

Despite that, as shown in column 2, the index invariably produces a positive investment return in the calendar year.

As far as the Nasdaq is concerned, there have only been 9 negative calendar years in the past 37 (despite the multiplicity and regularity of markdowns).

And as for the FTSE100, there have only been 11 negative calendar years since 1985 (again a period of 37 years).

Markets are dynamic and negative corrections are inevitable. They are always overcome.

I hope that this helps to reassure and put your mind at ease.

No Responses