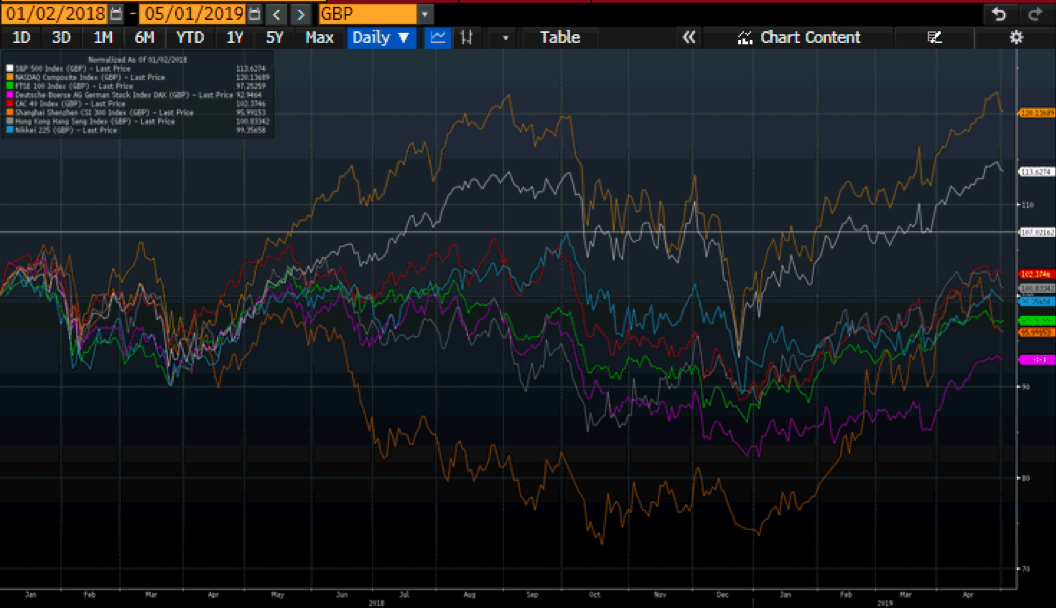

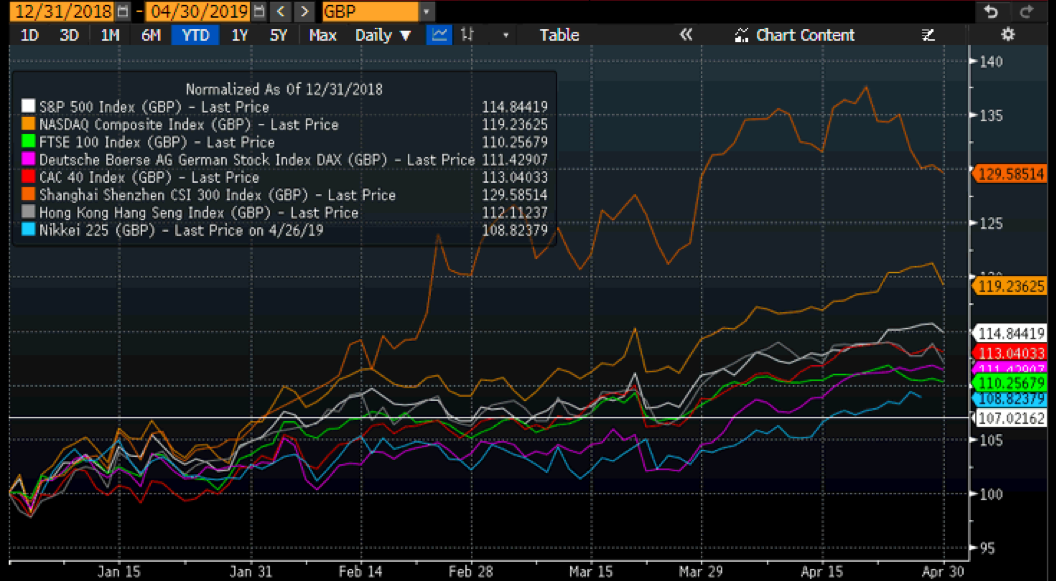

Following three months of lacklustre stock-markets and excessive price volatility we are pleased (not to say relieved) to report very positive upward momentum in April. Essentially, we view this as a ‘catch-up’ exercise after a period of markets going nowhere whilst there was a demonstrable disconnect between equity valuations and economic reality.

As we were approaching the first quarter corporate results season at the end of March we anticipated in last month’s report that the latest financial results would be far more positive than market analysts and the usual Wall Street pessimists were predicting and, indeed, that has largely been the case. The quarterly financial reports issued to date have been exceptionally good (many startlingly so) and this has been reflected in equity pricing. Future projections have also been mostly positive.

On 30th April 2021 the FTSE100 index closed the month at 6969.81 (a rise of +3.82% in the month of April) and it stands at up +7.88% for the 2021 calendar year to date. By comparison the Quotidian Fund’s valuation at the 30th April shows a rise of +4.51% for the month and that means that the Fund is now up +4.98% for the 2021 year to date.

In last month’s report we also mentioned a major sell-off in US markets as the result of the quite deliberate and substantial failure of a hedge fund by the name of Archegos Capital to meet its margin calls on short positions worth $20 billion. More details of that issue emerged as April progressed and it is worth mentioning the salient facts simply to give you an insight into unhelpful market practices in some areas of the world that then have negative consequences in others.

Archegos Capital Management is the investment vehicle for the mega-wealthy Hwang family (once of Hong Kong but now based in New York). Through the use of a range of derivative contracts (which are perfectly reasonable and rational investment vehicles in the normal course of events) Archegos built up very substantial short positions mainly in the technology and banking sectors. However, these shorts require and rely up on the investor to act in good faith and honour margin calls if and when their chosen trades, even briefly, go the wrong way. Hwang’s use of very complex total return swaps had helped to hide Archegos’s remarkably high exposures from its lending banks and, when its huge trades did indeed go bad, Archegos chose to renege on its commitments, thus triggering the need for these investments to immediately be liquidated ‘en bloc’.

Despite the obvious bad faith inherent in Hwang’s actions, it is the lending banks (largely Credit Suisse and Nomura) who have had to take the hit (which, in turn, has adversely affected the bank’s shareholders) as well as the shareholders in the various companies that Archegos had gone short on and whose shares had to be squared off at fire sale prices. Not a happy story but one that did not impact Quotidian’s holdings (other than by way of suppressing market confidence and creating unwanted short-term volatility).

Reliable figures are hard to come by but Bloomberg reported that Hwang had lost $20 billion in 2 days. Just another quiet day at the office then!

Much more reliable information is available from those banks that allowed the dishonourable Bill Hwang (who has past form in this regard and in 2014, was banned from financial trading in Hong Kong) to treat the stock market as a casino by lending incredibly enormous sums of money seemingly without any worthwhile analysis or purposeful process of risk management. His contempt for his lending banks and market rules beggars belief.

Credit Suisse has reported a loss of $4.7 billion in relation to its involvement with Archegos.

Nomura has similarly owned up to an Archegon-related loss of $2 billion.

Morgan Stanley has reported an Archegos-related loss of $911 million.

UBS also reported a loss of $770 million in respect of Archegos.

Mitsubishi UFJ Financial reported a loss of a mere $300 million on the same basis.

It’s hardly surprising to note that Archegos Capital Management is now defunct but, rather like Julius Caesar, the bad will live on long after it’s passing. The biggest question is whether Hwang will be called to account and adequately punished for what essentially was a crime. Don’t hold your breath.

In the meantime, Credit Suisse has announced that it will have to raise up to $2 billion in new capital to support its own equity base. Good luck with that one. This is the bank that had also been a leading lender to Greensill Capital (the UK investment house that David Cameron had, for a large fee, been an ‘adviser’ to). Despite (or perhaps because of) having had the full benefit of his financial wisdom, Greensill had, only in March, met the same grim fate as Archegos.

To back one big loser is unfortunate and regrettable; to back two huge losers within a month of each other smacks of over-exuberance in their analysis of risk combined with a lack of attention to detail bordering on recklessness. I have had to try very hard to avoid using the words Credit Suisse, risk management and frontal lobotomy in the same sentence. For any investor who is tempted to help Credit Suisse refuel its financial strength, I would merely suggest caveat emptor and, to Credit Suisse itself, I would recommend that a change of name to Credit Swizz might be appropriate.

Nomura’s US trading chief has stepped down; at least one honourable man found in a sea of sleaziness and incompetence.

With the finger-on-the-pulse alacrity, readiness and velocity we have come to expect from the world’s great financial regulators and compliance controllers, on 5th April (11 days after the proverbial had hit the Archegos fan) the USA’s Securities Exchange Commission announced that it was going to ‘conduct an investigation’ and, not to be outdone in the enthusiasm stakes, the UK’s Financial Conduct Authority has ‘requested information’. Well done chaps; perhaps we shouldn’t expect to see regulators and compliance to be first onto the dancefloor. Stable doors and horses come to mind and it is not unreasonable to believe that (given the costs in time, bloated paperwork and their annual charges) financial regulation and overseeing should be made of sterner stuff.

I expect that when, in the fullness of time, these august bodies eventually produce their reports, the findings will be masterpieces of self-serving bovine excreta. Indeed, they will likely be tours de farce.

It amused me to note that Credit Suisse’s risk management team was led by a chap called Brian Chin who has now (in US jargon) been freed up to pursue potentially more suitable and lucrative opportunities elsewhere. So it’s chin-chin to Mr Chin whilst, quaintly, CS’s investors have had to take their losses on the chin.

For your information and interest each individual stock-market listed company is given a risk rating on a scale of 1 to 6 (lowest to highest risk). Of our current holdings we have 9 at a rating of 1, another 7 at a rating of 2 and just 1 at a rating of 3. We have nothing at any higher rating.

De mortuis nil nisi bonum as the man on the Colosseum omnibus was wont to say as he merrily sipped his breakfast cappuccino. It is a maxim that, in general, one can agree with. However, there are occasional exceptions to this kindly and well-meant saying and Bernie Madoff is one of them.

His massive Ponzi fraud was eventually uncovered in 2008 having been developed over the previous 40 + years under the very noses of the financial authorities (who thought so highly of him that he was once appointed non-executive chairman of the Nasdaq stock-market, was also on the board of the Securities Industry Association (and Chairman of its trading committee) and also acted as an adviser to the US financial regulators and legislators. Madoff was the very definition of ‘hidden in plain sight’. Precise figures will never be known but the best estimate is that investors lost $19 billion in the collapse of his Ponzi scheme. For every loser there has to be a commensurate winner. Guess who it was.

Bernie the dolt’s indiscretions do suggest an individual who was not overburdened with powers of intelligence or morality and whose actions were motivated by sheer unbounded greed combined with great cunning and chutzpah. He died on 14th April at the age of 82 and, for very good but tragic reasons, was not mourned even by his own family.

By blissful coincidence, the presiding judge at Madoff’s trial was also a Mr Chin and, having studied mountains of evidence, this Chin sent Madoff down for a term of 150 years.

Madoff is the man we can thank for the dense thickets of overweening, often naïve, ill-informed, pointless regulation and compliance rules that bedevil the financial services industry today (to the point where one can barely complete even the most straightforward of tasks quickly and easily).

In the unlikely event that my rambling prose has retained your interest to this point, you will no doubt have already realised by now that the main theme of this month’s report is regulation and compliance in the financial services industry and its associated markets.

As strong believers in the age-old concepts of ‘utmost good faith’ and ‘my word is my bond’ as being the most effective regulations necessary to run orderly markets, (naïve, I know, in today’s day and age but it worked pretty well until the American banks invaded the City in the late 1980s and brought their interesting and unusual interpretation of investment ethics with them) you can only imagine the opinion we hold about the slippery Bernie and his ilk.

In global markets where nowadays one can move huge sums of money around the globe at the press of a button we, of course, fully understand, accept and support the need for robust regulation and compliance but that regulation must be well-informed, realistic and workable. It certainly should not be based on the concept of “one size fits all” and it should also start from a presumption of innocence rather than assumption of guilt that seems to be in vogue and which currently appears to dominate rule-maker’s thinking.

To illustrate those assertions it is worth noting that, since the year 2000 one large American bank has paid a total of $35,819,302,225 (yes, you read that correctly) in fines for a range of financial misdemeanours. Strangely, smaller financial organisations seem to cause much fewer problems. Perhaps it’s because they treat their clients with greater respect and know them far beyond just holding copy passports and utility bills.

For balance, let me add that a major European bank has amassed a total of $10,410,557,626 in fines for similar offences over the same time period. And to show that we are nothing if not even-handed, a major Far-Eastern bank has, since the year 2000, been fined $29,400,000 for the same range of transgressions.

These fines come under the headings, inter alia, of toxic securities abuses, tax violations, investor protection violations, economic sanctions, foreign exchange market manipulations and mortgage abuses. The Wolf of Wall Street was clearly not an entirely fictional film.

In light of these figures and the actions of the Madoffs and Hwangs of the world, it is blindingly obvious that regulation, supervision and compliance is very much required in the financial sector but, equally, it must allow markets, proficient boutique investment managers and small but professional financial advisers to function properly as opposed to stifling normal, reasonable and honest activity through the ever-increasing burden of over-heavy-handed rules-based constipation.

Under the guise of client protection, these ever-increasing ‘nanny state’ rules and restrictions invariably, in practice, operate palpably against the best interests of investors.

No doubt these rules are well-intentioned but they are dreamed up by ruling bodies that, so many times in the past, have shown themselves to be incompetent. Let me support that assertion with another couple of recent examples.

Despite repeated warnings of suspicious activity, the Financial Services Authority just in the recent past has overseen the demise of London Capital and Finance (costing UK taxpayers £120 million in compensation payments) and the collapse of ‘Blackstone Bonds’ at a cost to investors of £47 million. Both organisations were offering ‘low risk’ investment bonds which proved to be nothing of the sort. In the meantime the FCA was either asleep at the wheel or simply averted its eyes.

Still on the subject of regulation, after months of quite deliberate obstruction, obfuscation and delay (spiced with insults, premeditated and calculated rudeness together with ill-judged threats and demands) April saw the EU belatedly add its signature to the free trade deal which formed a vital part of Brexit.

The UK’s response to all this vindictiveness has been insipid to the point of lethargy. I can only think that Boris didn’t want to risk rocking the boat until the trade deal was formally ratified but now that the ink has dried on the required signatures it is a priceless opportunity to move rapidly forward to promote the UK’s best interests worldwide.

The financial industry is the largest contributor to the UK’s economy and the City of London is its epicentre. It has been obvious for quite some time that the EU is intent on stealing the City’s business and the profits it generates and the UK must now move to safeguard and then further develop its pre-eminent position in global financial services. In order to achieve that we therefore need a joined-up strategy and a rigorous, no-nonsense and experienced negotiator.

Whereas Tony Blair was rightly called a kipper (two faces and no backbone), Boris is more of a lobster (a hard exterior but a soft centre). Neither would be a suitable choice as a negotiator.

Sadly, whilst Boris has a variety of talents he also has a major character flaw that mitigates against his suitability as a negotiator. He is not a man for detail but much more a ‘concept’ man who wants (desperately) to be liked and that is something that a skilful negotiator can take advantage of (and that’s where Lord David Frost comes in).

The UK needs to adjust its taxation system to make it much more attractive to global investors as well as our home-based equity and other asset investment stakeholders.

In addition, the UK urgently needs to amend the framework of its regulatory and compliance arrangements to make them more realistic and fit for purpose. In other words it needs to remove the stranglehold that the EU’s penchant for over-regulation currently holds the financial services industry in thrall. By going back to basics we need move away from the current presumption of guilt and return to the presumption of innocence which is at the root of the British legal system (and which has been lost in the EU’s unseemly and unjustified rush to impose its heavy-handed systems of control).

Mifid I (The Markets in Financial Instruments Directive) was imposed by the EU upon the European Union’s financial services industry financial in 2007. Not content with tying up the European financial services sector with the constipation of knotweed introduced in Mifid 1, EU regulators moved swiftly on to its bigger brother Mifid II which, after a gestation period of eleven years was force-fed onto the financial industry in 2018 which introduced even more pointless and stultifying bureaucracy.

To give you a simple explanation of what we in the financial services currently have to contend with, Mifid II comprises 1.7 million provisions of box-ticking and meaningless guff (that is not an exaggeration) that we all have to contend with from rules and regulations that have been created by navel-gazing buffoons. Actually, one could be forgiven for amending that description to anal-gazing idiots.

By comparison, it is generally accepted that the Constitution of the United States is one of the best drafted pieces of legislation the world has ever seen. It comprises 4543 words and runs to 4 pages in its entirety (and even if you add its 27 later amendments it only takes the word-count to 7591).

It is clear that effective regulation needs only to be short, precise and to the point. The sooner that Mifid is repealed (or heavily redacted) in the UK and replaced by sensible, well-thought out and workable regulation that removes us from any vestiges of the EU’s orbit is based in the real financial world the better.

And finally, we offer our homage to Prince Philip, the Duke of Edinburgh who, as we all know, died on 9th April. Without fuss or flounce he supressed his inner alpha male persona for the greater good and, in so doing made a huge contribution to the well-being of the United Kingdom, its Commonwealth and its monarch, the Queen. He was a giant surrounded by the host of pygmies who comprise so much of the current political and public service world.

No-one dies until the ripples they have left fade away; and in the ongoing Duke of Edinburgh Award Scheme those ripples will last for eternity. We salute his achievements and mourn his passing The best and most apt eulogy I can offer is taken from a verse of poetry by Charles Spurgeon whose elegant use of the English language I gratefully acknowledge:

It takes more grace than I can tell

To play the second fiddle well

And for more than 70 years the Duke of Edinburgh played second fiddle as a maestro of the art.

It’s a strange quirk of the human condition that we often tend to take things for granted; “you don’t know what you’ve got till it’s gone” in the words of the Carly Simon song. And so, using Prince Philip as a proxy for those who are under-appreciated, let me also salute all those (particularly of the fairer sex who are the most likely to be in the frontline of this form of myopia) and who have foregone careers of their own in order to support their husbands or partners.

The Duke of Edinburgh would be tickled pink if he knew that he’d been the conduit for well-deserved recognition elsewhere…..and, you never know, the acknowledgement and appreciation could mean that your partner might be happy to be tickled pink too.