Quotidian Investments Monthly Commentary – April 2019

“Time reveals everything” is an old adage which is particularly true of the financial world. As you will no doubt recall, the 2018 investment year as a whole was dreadful and, from our own high point on 30th September, Quotidian’s performance mimicked the market’s downward trajectory so that our result for that calendar year was dismal too.

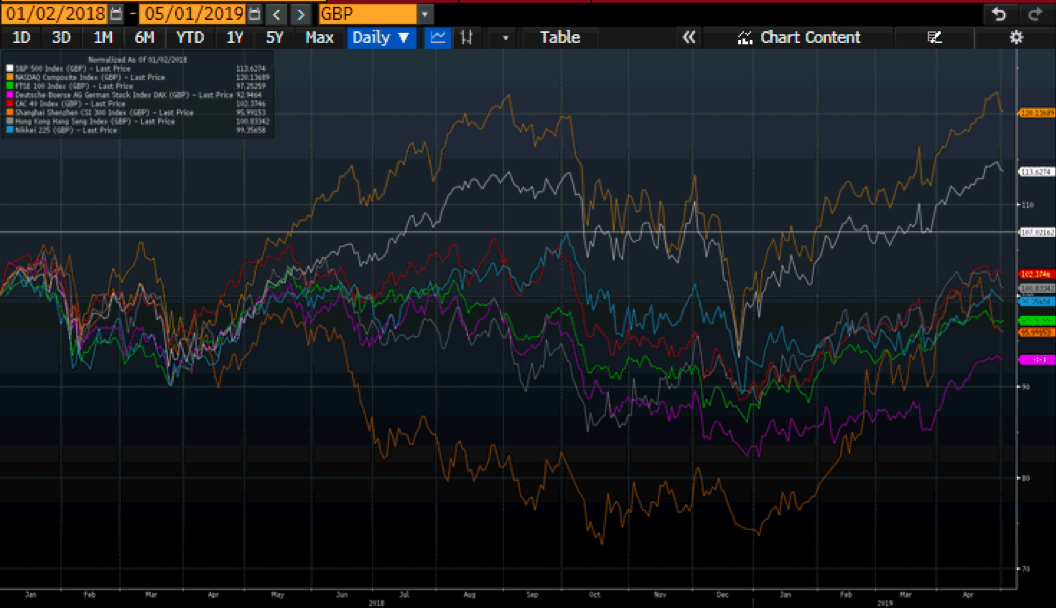

In particular, the last quarter of 2018 was one of the most difficult periods in global stock-makets since the depths of the financial crisis of 2007 to 2011. We did suggest at the time that this severe markdown was artificial, synthetic and overblown.

Here we are just four months later and, indeed, time has put the travails of 2018 into better perspective. In support of our contemporaneous assertions, we can now see that by the end of April 2019 the most attractive of the global markets (the Nasdaq and the S&P500; both in the USA) have already recaptured the reduction in equity valuations of the last three months of 2018.

On 30th April 2019 the FTSE100 index closed the month at 7418.22, a rise of +1.91% in the month of April itself and it now stands at +10.26% for the 2019 calendar year to date. By comparison the Quotidian Fund’s valuation at the same date shows an increase of +4.52% for the month of April and the Fund is now up +24.79% for the 2019 year to date.

Quotidian’s investment strategy is based upon being (or at least aiming to be) in the right sectors of the right markets at the right time.

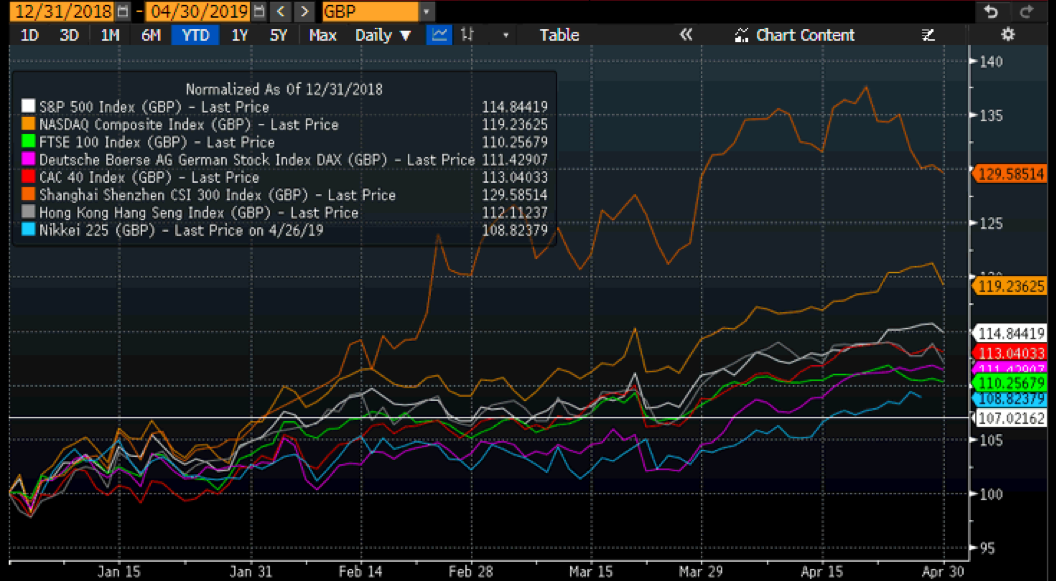

With that in mnd and on the basis that a picture paints 1000 words, I attach two graphs for your information and interest. The first illustrates the extreme volatility of global stock-markets from 1st January 2018 up to the present day and the second graph shows the performance of the most important of the worldwide markets from the start of 2019 up to 30th April.

These graphs confirm that the leading three equity markets for a GBP investor thus far in 2019 are China, the Nasdaq and the S&P500. It is no coincidence, therefore, that our current portfolio is 80% invested in those two US markets and 20% invested in UK Smaller Companies.

We do not invest in China simply because long experience of that market leaves us feeling less than secure about its corporate governance, the lack of quality of economic and financial information emanating from that country and our concerns over its stock-market illiquidity.

Simliar concerns negatively influence our view of Emerging Markets. We also remain shy of the relentlessly underperforming stock-markets of Europe until such time as its political and financial woes are better managed.

Our strategy should not be seen as dogmatic; our thinking is flexible and our decision-making can be mutated to suit current market conditions and ever-changing circumstances.

Time does reveal all and visual aids hopefully help to illuminate my usual dull commentary ……..but please don’t think for a minute that I won’t continue to use a 1000 words anyway in future reports!

No Responses